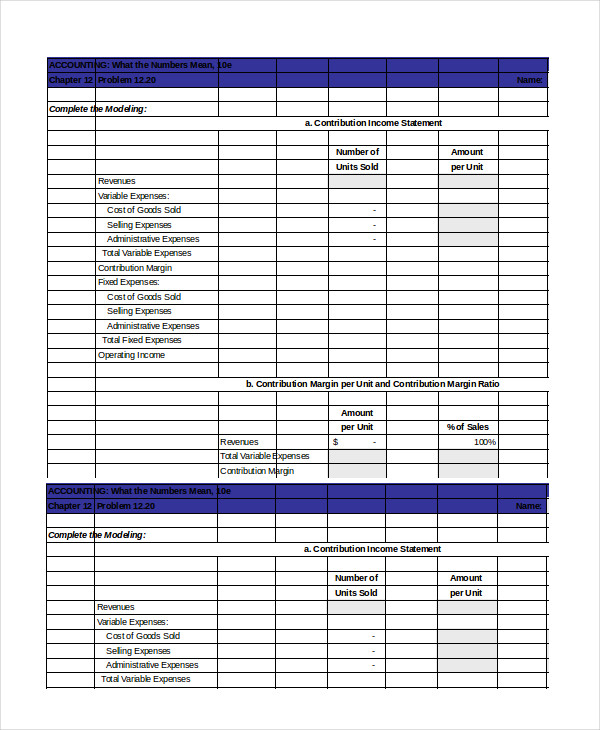

You will also learn how to plan for changes in selling price or costs, whether a single product, multiple products, or services are involved. The contribution margin income statement is a superior form of presentation, because the contribution margin clearly shows the amount available to cover fixed costs and generate a profit (or loss). It is useful to create an income statement in the contribution margin format when you want to determine that proportion of expenses that truly varies directly with revenues.

How can Taxfyle help?

Traditional statements are required because they conform to GAAP accounting standards, and they are prepared for external audiences, including investors, lenders, and regulators. Both methods lead to the same operating income, though they arrive via a different route. This metric is typically used to calculate the break even point of a production process and set the pricing of a product. They also use this to forecast the profits of the budgeted production numbers after the prices have been set. Because this figure is usually expressed as a percentage, we’d then divide the contribution margin by the revenue to get the ratio of 0.44.

What is a contribution format income margin?

A traditional income statement is prepared under a traditional absorption costing (full costing) system and is used by both external parties and internal management. When the contribution margin is credits and deductions for individuals calculated on a per unit basis, it is referred to as the contribution margin per unit or unit contribution margin. You can find the contribution margin per unit using the equation shown below.

Analysis and Interpretation

These costs are important because they directly affect how much money a business can make from selling its products. For instance, if the costs of sugar and cups for your lemonade stand go up, you’ll have less money left over from each sale. This is crucial for a business to understand because it helps them see which products are really making money and which might be losing money. However, the growing trend in many segments of the economy is to convert labor-intensive enterprises (primarily variable costs) to operations heavily dependent on equipment or technology (primarily fixed costs). For example, in retail, many functions that were previously performed by people are now performed by machines or software, such as the self-checkout counters in stores such as Walmart, Costco, and Lowe’s.

- Keep in mind that contribution margin per sale first contributes to meeting fixed costs and then to profit.

- This detailed breakdown helps in understanding the financial performance of individual products or services.

- For example, analysts can calculate the margin per unit sold and use forecast estimates for the upcoming year to calculate the forecasted profit of the company.

- In this chapter, we begin examining the relationship among sales volume, fixed costs, variable costs, and profit in decision-making.

Differences Between Traditional and Contribution Income Statements

Variable costs are less than COGS, which also may include fixed and variable costs, so a business’s contribution margin is usually higher than its gross margin. Contribution margin income statements can help business managers control costs, set prices, and make decisions about business segments, such as expanding profitable product lines or discontinuing less profitable ones. A contribution margin income statement varies from a normal income statement in three ways. First, fixed production costs are aggregated lower in the income statement, after the contribution margin.

Understanding the Contribution Income Statement: A Comprehensive Guide

You’ll notice that the above statement doesn’t include the contribution margin. That’s because a contribution margin statement is generally done separately from the overall company income statement. EBIT provides an overall view of the company’s profitability level, whereas contribution margin looks at the profitability of each individual service or product. EBIT features in a company income statement as it gives the operating figures of a business more context.

The calculation looks at fixed expenses (like the money needed for the shop) and how much each sale contributes after variable costs are paid. This helps businesses plan better, like knowing how many toys need to be sold to pay for the shop and the toy parts. It’s a big part of accounting and helps keep the business running smoothly without losing money. Traditional statements calculate gross profit margin, which is determined by subtracting the cost of goods sold (COGS) from revenue. Contribution format statements produce a contribution margin, which is the result of subtracting variable costs from revenue.

After further work with her staff, Susan was able to break down the selling and administrative costs into their variable and fixed components. (This process is the same as the one we discussed earlier for production costs.) Susan then established the cost equations shown in Table 5.5. This is the net amount that the company expects to receive from its total sales. Some income statements report net sales as the only sales figure, while others actually report total sales and make deductions for returns and allowances. Either way, this number will be reported at the top of the income statement.