A contribution margin is a gap between the revenue of a product and the variable costs it took to make it. Earnings Before Interest and Taxes (EBIT) is the company’s net income before applying taxes and interest rates. While the contribution margin shows the money left over for paying fixed expenses and profit, income is the total of a company’s revenue, other investments, and losses.

What is a contribution format income margin?

As we said earlier, variable costs have a direct relationship with production levels. The contribution margin is the foundation for break-even analysis used in the overall cost and sales price planning for products. This covers the product costs, but remember we must include all the variable costs.

The Difference Between a Contribution Margin Income Statement and a Normal Income Statement

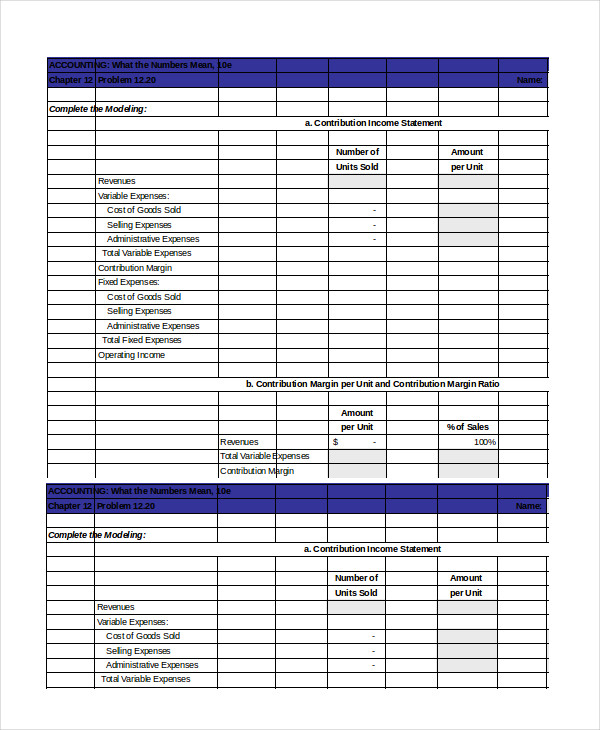

When comparing the two statements, take note of what changed and what remained the same from April to May. Remember the format and ignore the traditional (absorption) income statement. Most students that have trouble with this statement try to relate it back to what is happening on the traditional income statement. Throw out what you know about the traditional income statement when doing the contribution margin income statement. Add fixed overhead and fixed selling and administrative to calculate total fixed cost. In May, \(750\) of the Blue Jay models were sold as shown on the contribution margin income statement.

Highlights of changes for 2025

It is primarily used for external financial reporting, providing a comprehensive overview of a company’s financial performance. However, ink pen production will be impossible without the manufacturing machine which comes at a fixed cost of $10,000. This cost of the machine represents a fixed cost (and not a variable cost) as its charges do not increase based on the units produced.

- As long as the data entered into the database is correct, both reports can be prepared in a matter of minutes.

- While it cannot be used for GAAP financial statements, it is often used by managers internally.

- To calculate sales, take the price of the product and multiply by the number of units sold.

- Fixed production costs were $3,000, and variable production costs amounted to $1,400 per unit.

- You can connect with a licensed CPA or EA who can file your business tax returns.

- It’s like knowing if you have enough money left for more lemons or a new pitcher.

Variable costs are not typically reported on general purpose financial statements as a separate category. Thus, you will need to scan the income statement for variable costs and tally the list. Some companies do issue contribution margin income statements that split variable and fixed costs, but this isn’t common. In other terms the contribution margin is a key tool in financial analysis. It helps in understanding the variability of costs, the proportion of sales that is actual profit, and when a business will start making money instead of just covering costs.

Such fixed costs are not considered in the contribution margin calculations. A contribution margin income statement, on the other hand, is a purely management oriented format of presenting revenues and expenses that helps in various revenues and expense related decision making processes. For example, a multi-product company can measure profitability of each product by preparing understanding accounts payable ap with examples and how to record ap a product viz contribution margin income statement and decide which product to continue and which one to drop. Companies are not required to present such statements to any external party, so there is no need to follow GAAP or IAS. Instead, management needs to keep a certain minimum staffing in the production area, which does not vary for lower production volumes.

The more it produces in a given month, the more raw materials it requires. Likewise, a cafe owner needs things like coffee and pastries to sell to visitors. The more customers she serves, the more food and beverages she must buy. Direct materials are often typical variable costs, because you normally use more direct materials when you produce more items. In our example, if the students sold 100 shirts, assuming an individual variable cost per shirt of $10, the total variable costs would be $1,000 (100 × $10). If they sold 250 shirts, again assuming an individual variable cost per shirt of $10, then the total variable costs would $2,500 (250 × $10).

It’s like when you save money from your allowance after buying something you want. Regardless of how contribution margin is expressed, it provides critical information for managers. Understanding how each product, good, or service contributes to the organization’s profitability allows managers to make decisions such as which product lines they should expand or which might be discontinued. When allocating scarce resources, the contribution margin will help them focus on those products or services with the highest margin, thereby maximizing profits. To illustrate how this form of income statement can be used, contribution margin income statements for Hicks Manufacturing are shown for the months of April and May.